Blog

1ST QUARTER 2021 INVESTMENT COMMENTARY

While writing our quarterly review this time last year, the stock market was beginning a recovery following a ferocious decline […]

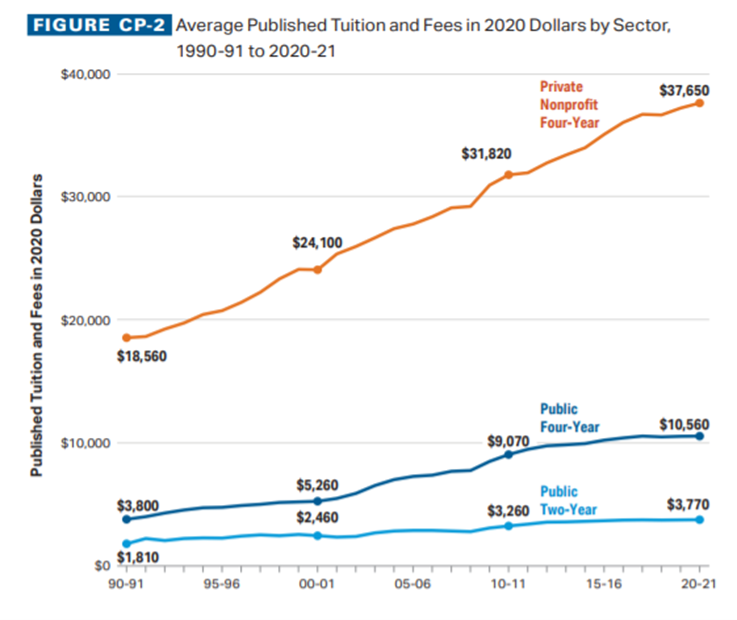

IS COLLEGE INFLATION SLOWING?

For many families, helping to fund college expenses is a major financial goal. According to reports from The College Board, tuition […]

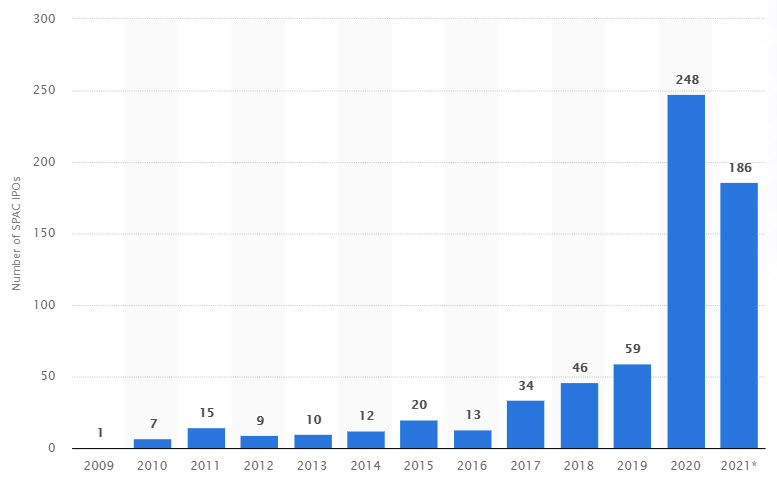

SPAC-MANIA

In 2020 we saw a new resurgence in an old investment vehicle called a SPAC. SPAC stands for Special Purpose Acquisition […]

FASTEN YOUR SEATBELTS

Consumer spending is the life blood of the U.S. economy and policymakers devoted much of 2020 to bolstering future demand. A […]

BITCOIN’S BAA-AACK

It seems not a day goes by without various news outlets talking about Bitcoin and digital currencies. It’s reminiscent of […]

4th Quarter 2020 Investment Commentary

In 1985 we were introduced to Doc Brown, Marty McFly and their retrofitted DeLorean time machine in the movie Back […]

Emerging Markets Look Interesting

Not many people are talking about emerging markets (EM) lately but that may be about to change. For a long […]

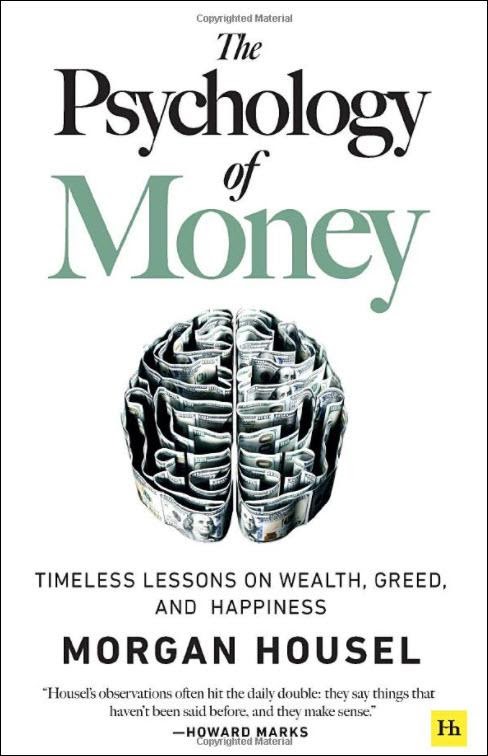

Book Review

Morgan Housel’s The Psychology of Money was released in early September and IT IS EXCELLENT. Housel delivers twenty chapters that can be […]

Tech Mania 2.0?

We continue to hear commentary that suggests certain parts of the market look and feel a lot like the tech […]

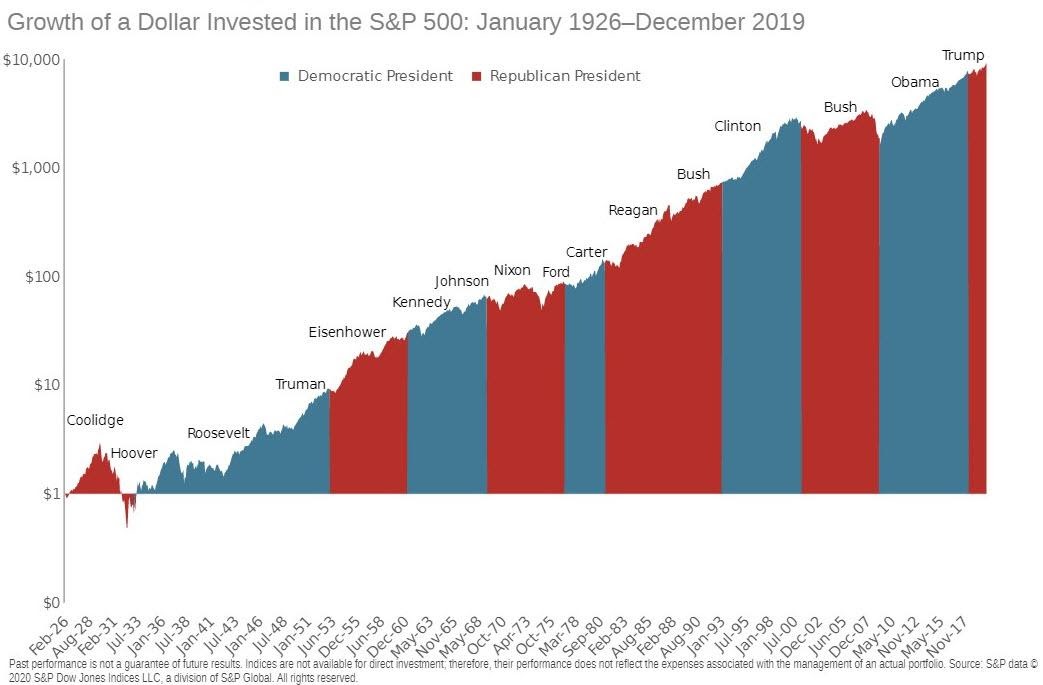

A Picture Is Worth A Thousand Words

Election day is finally here folks! Probably like you, we are a little bit tired of reading and talking about […]

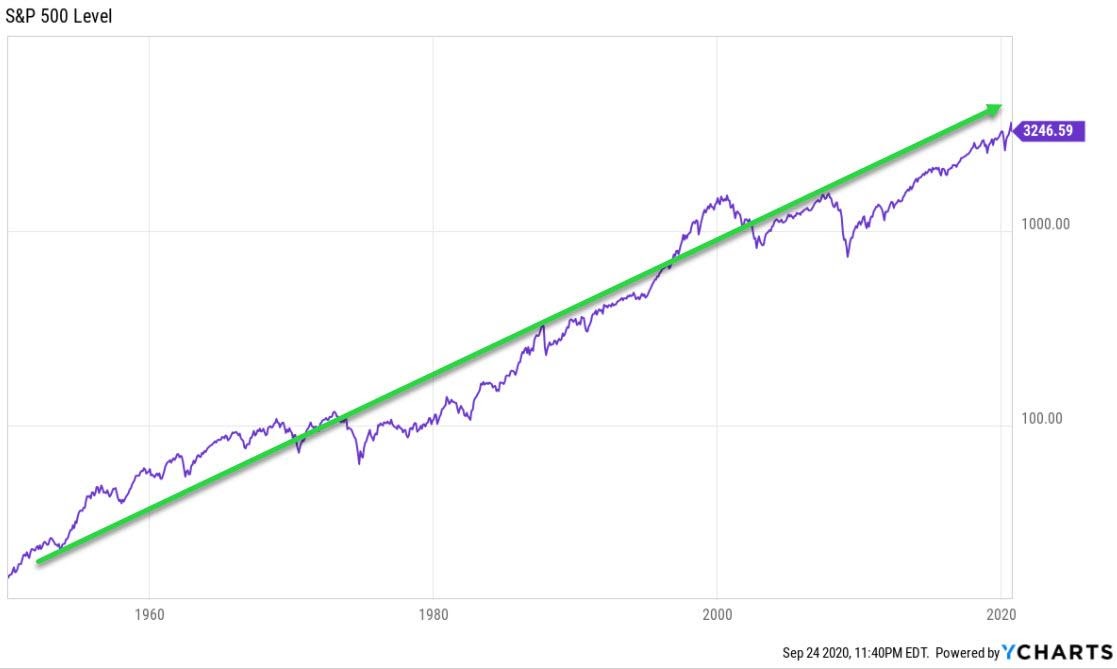

Is It Contrarian To Be An Optimist?

Optimism: The odds of a favorable outcome are in your favor over time, even when there will be setbacks along […]

Easy Policy Is Here To Stay

The Federal Reserve has two primary jobs: maintaining maximum employment and stable prices. How it achieves this is changing. Last […]