Is It Contrarian To Be An Optimist?

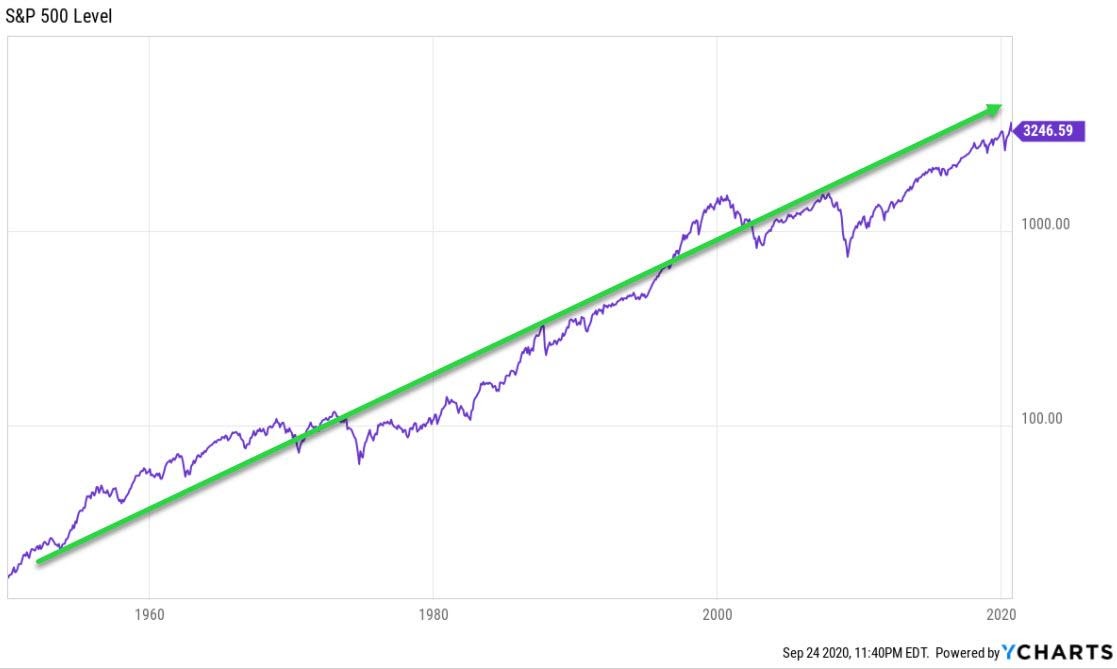

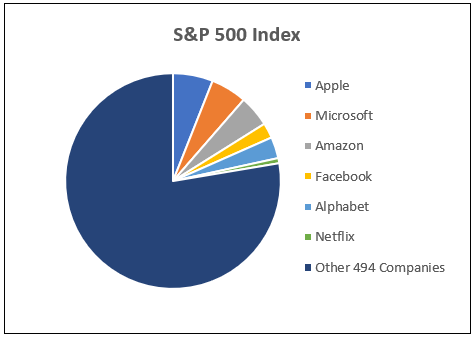

Optimism: The odds of a favorable outcome are in your favor over time, even when there will be setbacks along the way. One of the things we say internally is that we give our clients the confidence to invest. What we really mean is that we encourage them to invest in equities with their long-term … Read more