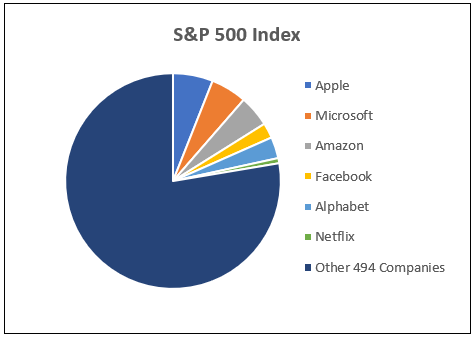

The Big Six

Six stocks currently make up almost 22% of the S&P 500 Index: Facebook, Amazon, Apple, Alphabet (Google), Netflix and Microsoft. Their dominance has been the source of fantastic debate in the investment community. Check out the following stats: Since the beginning of 2015, these stocks produced a cumulative return of +236%. The other 494 stocks … Read more