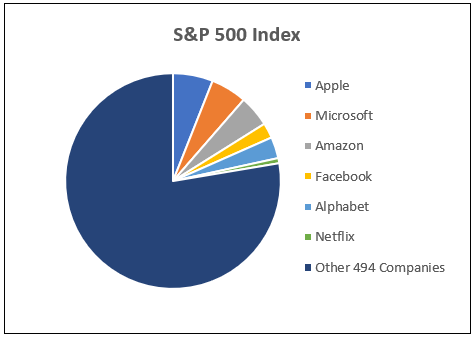

Six stocks currently make up almost 22% of the S&P 500 Index: Facebook, Amazon, Apple, Alphabet (Google), Netflix and Microsoft. Their dominance has been the source of fantastic debate in the investment community. Check out the following stats: Since the beginning of 2015, these stocks produced a cumulative return of +236%. The other 494 stocks in the index returned just +39%. In terms of wealth accumulation, these six companies have created roughly 60% of the dollar gains in the index in that time. Many investors are comparing this phenomenon to the late 90’s and the astronomical valuations that accompanied names like Cisco, Qualcomm and (yes) Microsoft. We could make the case that there are similarities but won’t go much further than that.

Two things we will say…the first is regarding the concept of portfolio management. This encompasses all the broad decisions around how to build and manage an investment portfolio. Deciding to buy Pepsi rather than Coke is not a portfolio management decision – it’s what we call security selection. (Yes, the two differ.) Portfolio management is about allocating between asset classes, styles, sectors and other factors. It encompasses risk management and relative results vs. a market benchmark. It’s not the exciting stuff but it is critical to success. For example, if you made the bold decision to underweight this group of stocks or move out of them all together, you have missed out on their gains and lagged the market by a wide margin. As an advisor, if you base your long term planning approach on receiving the outstanding returns the market provides over time (which we do), you can’t turn around and say “I know better” and completely move out of stocks just because they momentarily represent 22% of the broad market. That’s an enormous bet!

The second point is the simple notion that we don’t know what the future holds. Yes, there are some basic concepts we hold dear. Capitalism will persevere and the U.S. will continue to prosper, and therefore companies will innovate and create wealth over time. This has held true for hundreds of years. But the current pandemic reminds us that the short term is simply unknowable. These six stocks (and many others) have been incredible beneficiaries of the economy’s shutdown. Trends such as cloud computing, video conferencing, virtual pay, at home entertainment and so many others have only been accelerated. These companies that many have criticized for being too expensive, too big, too exposed to political scrutiny, too powerful over the working class, etc. have benefited tremendously and so have their shareholders.

We aren’t pounding the table that their current dominance will continue indefinitely. In fact, this type of concentration should be closely monitored along with other fundamental factors that this article doesn’t address. History tells us that eventually change in leadership will occur, it’s the timing that is completely uncertain. We don’t pretend to know when that will happen so for now, we wouldn’t bet against this group.