Popular wisdom holds that stocks are risky and bonds are safe. Over the last several months, huge amounts of capital have flowed out of stocks and into bonds as investors fled to the perceived safety of bonds. But is it “safe” to loan money for ten years at 0.7%, or for 30 years at 1.5%? That’s the going rate for US Treasury Bonds, considered the safest bonds in the world. Do not confuse price volatility with risk. Yes, stock prices fluctuate more than bond prices and are thus more volatile. But bonds can also lose value and have experienced long periods when they did just that.

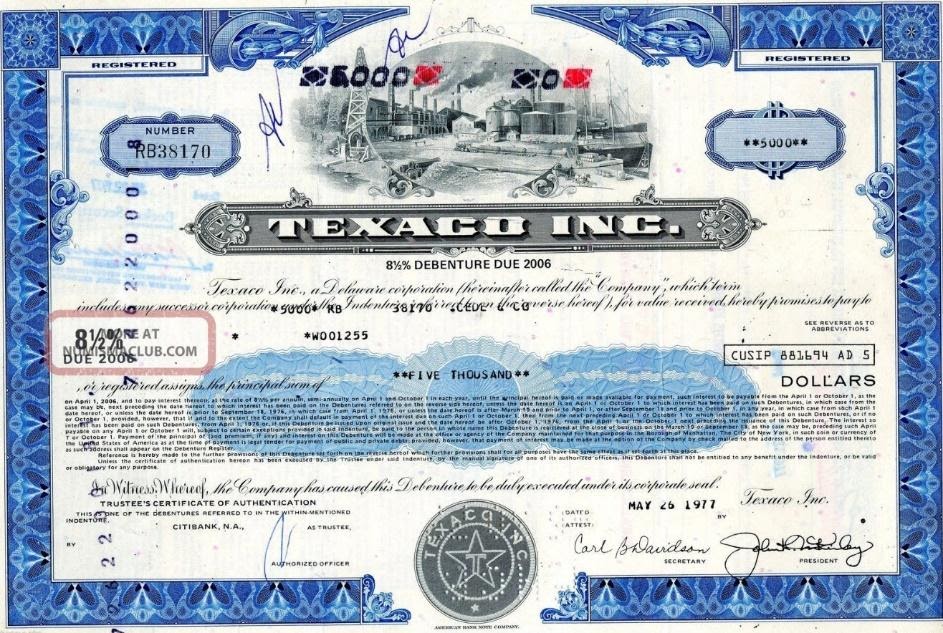

In our office, Jim Torrey has an anecdotal tale. Jim’s been around for a long time (he prefers not to reveal just how long) and remembers very clearly a situation that demonstrates the potential risk to owning bonds. In 1953 one of his family members bought an investment-grade 30-year bond issued by Texaco. The bond was issued at par, meaning each $1,000 bond cost $1,000 to buy. It paid interest at an annual rate of 3.5%, not bad in a world where inflation was around 0.75% and the prime rate was 3%. Texaco was one of the biggest companies in the country and economic conditions were stable, so buying a long-term bond was not considered very risky.

Over the course of the next 20 years, annual inflation rose to 12.3% and the prime rate rose to 12%. At the time of the investor’s death in 1977, his Texaco bond had a value of less than 75 cents on the dollar.

We cite this as an example of the risk that supposedly safe bonds can really hold. Inflation today is less than 1%, the prime rate is 3.25% and an intermediate-term gilt-edged corporate bond yields less than 1.25%. Not a very attractive time for bonds, in our view. In times of rising inflation and interest rates, bond prices decline. Interest rates have been declining for the past forty years and are now at rock-bottom levels. Over the next ten years that phenomenon is unlikely to continue. With bonds yielding so little, they are utterly unprotected against rising inflation and interest rates.

We do hold bonds and bond funds in client portfolios, but at this stage in the interest-rate cycle those bonds are of high credit quality and short to intermediate maturity. Those features will limit the impact of higher rates to some degree. Internally, we continue to research and debate solutions to this dilemma. For now we believe rates and inflation will remain stable in the near term but we are planning how to respond when that changes.