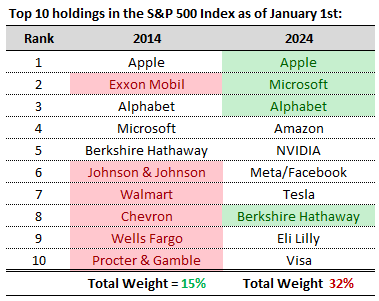

When you think of the S&P 500 Index, you probably think of a diversified index of the best, or at least the biggest, 500 companies in the nation. While this is generally correct, the S&P 500 is currently the most concentrated it has been in four decades. The top ten most highly-valued companies in the index now comprise 32% of the entire index. This is not the highest level it has ever been, but it is nearing historical highs.

There are numerous factors that have created today’s environment. Most importantly, these companies are among the most profitable in the world and have capitalized on transformative technological trends. These companies have undoubtedly proven their value to the world.

Investing solely in these companies over the past ten years has produced unprecedented results. Another factor for the great results is that ten years ago the top ten companies in the S&P 500 had the lowest level of concentration in the modern era at only 15%. Now let’s ask the question – how many of today’s top 10 companies were in the top 10 a decade ago?

The answer is four: Apple, Alphabet, Microsoft, and Berkshire Hathaway. Historically speaking, this is very normal as typically four to seven of the current top 10 companies will drop off the list. This means it is extraordinarily difficult for the biggest ten companies to collectively outperform the market. In hindsight, investing in the S&P 500 when concentration was at all-time lows was an excellent bet. Today’s situation is very different since investing in the S&P 500 is a concentrated bet on a small number of companies that are prone to below-average returns over the next decade. Additionally, the 10-year forward return of the S&P 500 index has been below average during high-concentration periods. Investors will need to adjust their way of thinking, and their portfolios, to earn adequate returns the next decade.