Several trends changed course in the third quarter as both stocks and bonds fell a er rising in the first half of 2023. The reversal reflected concerns about rising rates, Fitch’s downgrade of US Government debt, and the narrow avoidance of a government shutdown. Despite the negative quarter, signs in the economy are positive. The most predicted recession ever has yet to occur, and economists are pushing out forecasts accordingly. Bank of America’s Chief US Economist pushed back his call for a recession earlier this year and even called it a “growth recession”, an obvious oxymoron. The fact that the economy has been so resilient in the face of higher inflation and a 5.25% increase in Fed funds rates is remarkable.

One of the main reasons for this resilience is the strength of the jobs market. It turns out that people who are employed continue to spend and the September jobs report was stellar. There’s also data to suggest that nearly half of household excess savings amassed during 2020-2021 has yet to be spent. JP Morgan estimates this number to be $1.2 trillion. Yes, savings rates have fallen but that’s because excess savings exist and continue to be spent. TSA checkpoint data shows that travelers are back to pre-pandemic levels and some months have shown new all-time highs. This is occurring as ticket prices experience some of the highest year-over-year price hikes in decades. September retail sales were just reported and were significantly better than expected, and the solid August numbers were adjusted higher. As many of you know, the consumer represents two-thirds of the US economy, and it is showing.

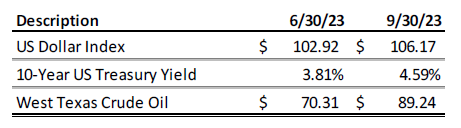

The government is the other third and we know they are spending. While we point out some of the positives, we are not blind to the risks. The triple threat of strength in the US dollar, rising interest rates, and increasing oil prices are worth monitoring. Each of these puts downward pressure on key parts of the economy and are obvious factors that contributed to the third quarter sell-off.

The broader bond market benchmark was down 3.2% for the quarter, which ironically is almost the same as the S&P 500. This decline pushes bonds into negative territory and would be the third consecutive year of negative returns for the bond market if we ended the year at these levels. As mentioned earlier, rates have risen at a furious pace. Remember, the Fed controls short-term rates and they elected to pause (not raise rates) at their last meeting. But the market controls longer-term rates and there has been a tremendous increase in a short period of time. The 10-year Treasury yield was at 3.8% on June 30th. Today it stands around 4.9%. That’s an incredible move in 100 days. As many of you know we are fans of shorter-term Treasuries, and we adjusted portfolios long ago to add these positions. As a result, our bond portfolios are positive on the year, so we feel great about the tactical shift.

The S&P 500 index fell 3.3% during the third quarter and as of 9/30/23 was up 13.1% on the year. Most stocks have not fared as well this year. Smaller companies fell 4.7% in the quarter and are up only 2.5% year to date based on the Russell 2000 Small Cap Index. And the performance of the S&P 500 is deceiving. The index is ‘cap weighted’ meaning the returns are weighted to the largest companies in the index. Meet the magnificent seven: Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla. Yes, there’s a new buzzword for the group of stocks driving the market. These seven companies make up 28% of the index and, therefore, their collective results drive as much of the returns. Their results in 2023 have been phenomenal. One could easily make the case that nearly 90% of the returns in the market this year are attributed to these seven companies – all based on their size. If we simply remove these seven names, returns would be positive this year…but only by two or three percent. This is called a narrow market. Here’s an example to illustrate.

Microsoft (MSFT) and Verisk Analytics (VRSK) are two companies that have both returned 30%+ this year. Verisk, an analytics provider to the insurance industry, is a $34 billion company. Microsoft is a $2.5 trillion company. Verisk’s weight in the S&P 500 index is 0.09%. Microsoft’s is 6.5%. Verisk could double in the fourth quarter, and the S&P 500 would hardly budge. If Microsoft doubled, you’d see the index go up an additional 6.5%.

History suggests that outperformance is challenging for companies when they become such a dominant part of the index. Think of companies like GE, Exxon, Cisco Systems, IBM, etc. But remember, if one chooses not to own any of these names it would be a massive bet against the market since they represent such a large component. We are investors in these stocks, but we don’t have 28% of any portfolio in seven stocks. We pick and choose our weights and would be happy to discuss our logic offline if you’d like to hear.

Think about the fact that five years ago, the S&P 500 index stood at 2800 and was in the midst of the longest bull run in history. The US had strong economic growth, record-low unemployment, and relatively low inflation. But several factors outweighed those positives and the market fell nearly 20% by Christmas Eve 2018. Pundits blamed a trade war with China, slowing global growth, and Fed interest rate hikes. The market would experience three “bear markets” over the coming five years. Less than a year and a half later (early 2020) the pandemic swept the globe and the market fell 34% in 33 days. Less than two years later (beginning in 2022) we witnessed a 25% ten-month decline due to recession fears, spiking inflation, and massive Fed rate hikes. Five years, three bear markets, and one official recession that occurred during the pandemic sounds like a rough ride. Except that it wasn’t. The S&P 500 stood at 4288 at this quarter’s end, and with dividends reinvested, represents an 11% annual return. Even investors that diversified globally saw an 8% annual return over the same period, as measured by the MSCI All Country World Index.

We don’t know what the next five years hold for the capital markets, but we do know the investing public is a lot more cautious today than they were in the fall of 2018. For nearly two years fears of a recession have been circulating, and it has yet to occur. Valuations are more attractive for most stocks today. Interest rates are much higher which leads to much higher return expectations for bonds. It’s easy to point out the risks and talk about what is going in the wrong direction. This blog didn’t even touch on many of those topics. While we consider those risks and think about how they might affect our portfolios, we think it’s also important to ask the question: What could go right?