Inflation has shot to the top of investors’ list of concerns after an April Consumer Price Index (CPI) report was much higher-than-expected. We aren’t particularly surprised. This has been an ongoing drumbeat dating back to the global financial crisis in 2008-09. Here are a few things to keep in mind.

Base Effects – Any measure today compared over the last year will be skewed. Last year, the global economy was locked down creating severe and temporary slumps in supply AND demand. Prices fell dramatically. Last April’s CPI dropped 0.7% during the month – its largest monthly decline since 1950 outside of the 2008-09 financial crisis. More than 12 months later, a one-year difference compares today’s price level to a very low point, making the near term change look dramatic. We have seen inflation spikes occur during short-term periods, like April 2021. A significant part of that increase comes from prices having rebounded after a great decline.

Price Inflation – All this isn’t to say that rising prices are entirely due to base effects. We have certainly seen higher prices throughout the economy: lumber, corn, copper, semiconductors, residential homes, and automobiles to name a few. Some of these are showing up in a surge in producer prices, a gauge which recently had its largest 12-month gain in nearly a decade. Part of the rise in producer prices can be attributed to ongoing bottlenecks and supply chain issues globally. Many economists believe these constraints are temporary consequences from the timing of the rapid recovery in demand. We tend to agree. The recent surge in inflation is likely temporary and prices will eventually level off, or possibly decline, as production catches up to demand. Admittedly, it could take several months for supply/demand to equalize. It also remains to be seen how successful companies will be in passing on higher costs onto customers. There is an old saying that “the cure for high prices, is high prices”. Additionally, there is an abundance of investment capital around the world willing to produce supply and expand capacity, which gives us confidence that prices will eventually moderate or even retreat over the next year.

Lastly, the 10-year Treasury yield is around 1.6% and has been flat for a few months. If inflation was a significant concern, it would almost certainly show up in the bond market (i.e. higher interest rates). For now, it’s worth monitoring the recent price swings, but we aren’t ready to predict meaningfully higher inflation in the near future.

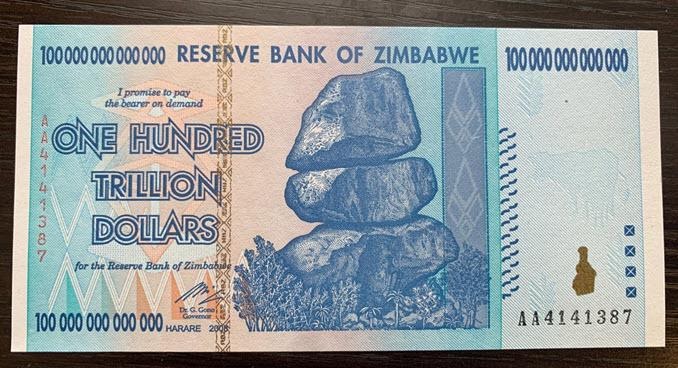

Note: The Zimbabwe one hundred trillion dollar note pictured above is real. We like to keep a couple hundred trillion in cash at the office to remind us what real hyperinflation looks like.