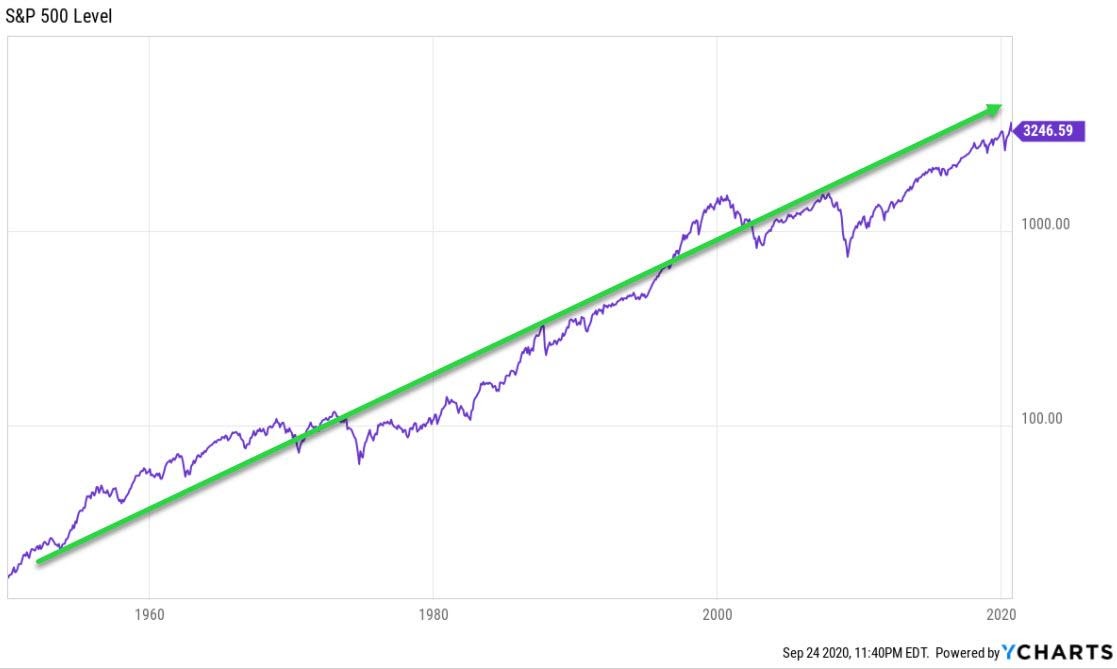

Optimism: The odds of a favorable outcome are in your favor over time, even when there will be setbacks along the way.

One of the things we say internally is that we give our clients the confidence to invest. What we really mean is that we encourage them to invest in equities with their long-term capital because stocks are the greatest vehicle for wealth creation for individual investors over time. It sounds too simple right? It’s because there are always reasons not to invest in stocks – as if we had to tell you that in the fall of 2020. The case for stocks to go down is always more compelling than the “stay the course” message preached by prudent investors. Human behavior suggests we are much more likely to tune in when a smart, credentialed person predicts doom and gloom. Compare that to an advisor who suggests stocks are likely to be positive and outperform bonds over the next decade. SNOOZE ALERT!

Here’s the dirty secret about investing. Harder work does not lead to better investment results. More credentials do not correlate to higher returns. Think about that. In what other industry could you say that? If you want to increase your returns, do one thing: increase your time horizon. Stop trying to predict when the Nasdaq will tank. Stop worrying about the effect of the election results on your portfolio. Stop investing in high cost, complicated funds that promise to outperform with less risk. Every person reading this has capital that can be invested beyond a 5 to 10-year horizon. We aren’t naïve. There will be setbacks along the way, but odds of a favorable outcome are very much in your favor over time. Be optimistic and invest in stocks for the long run. We are.