Many of our clients have recently received annual notices of property tax assessments on their homes, and those assessments are higher across the board. In Texas, increases are limited to 10% over the prior year in most cases but in some states that limit doesn’t apply. If one were to pull up Zillow and check the Zestimate of a home’s value, the increase is likely to be significantly higher. Home prices have simply skyrocketed everywhere. This time two years ago, the median home price in the country was $325,900. Today it is $420,000. That’s a 29% increase in just two years and it’s much higher in desirable communities across the country.

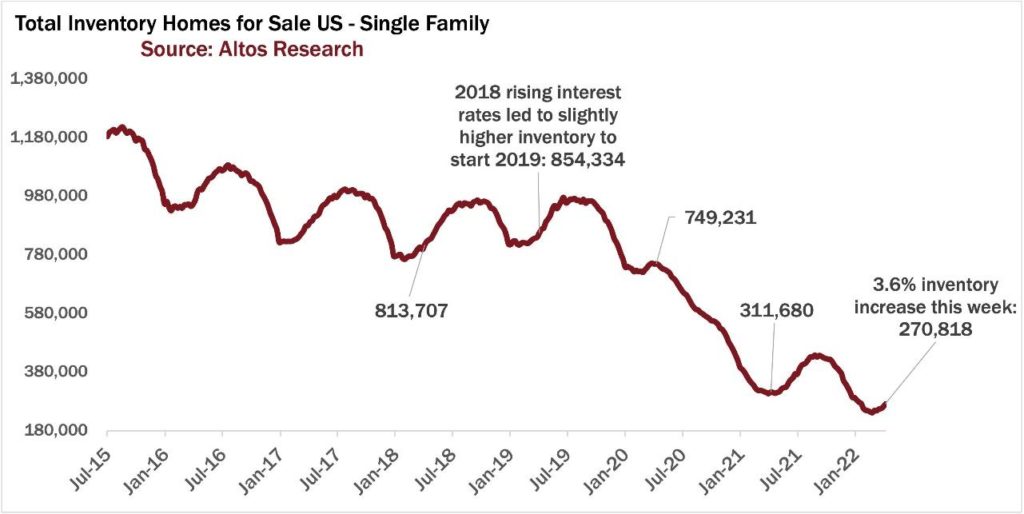

Why is this happening? First, there’s no inventory. In mid-2015 there were almost 1.2 million homes for sale in the U.S. Today, there are 280,000 (a 77% decline). Part of the reason is the lack of new home construction. The housing crisis burned the home builders that were overextended. They pulled back and the pace of new home starts slowed significantly. Homebuilding has been on the rise for several years but the underinvestment has been massive. In 1985 there were 1.8 million housing starts and 235 million people in the country. Today housing starts are about the same and there are 334 million people in the US. Freddie Mac recently estimated that we are 3.8 million homes short of current demand. Lastly, consider that the largest demographic in the country today is the millennials. They are pouring into the housing market and accounted for more than half of all mortgage loan applications in 2021.

It’s natural for observers to look at what’s happening in the housing market and make comparisons to the housing crisis of over a decade ago. People will suspect a bubble or utter phrases like “this will end badly”. We would argue this is not the case at all. The current rate of appreciation is not sustainable, but that’s not to say prices are destined to decline. Instead, it is more likely that home price appreciation will stabilize while remaining positive. Given these fundamentals, strong housing demand looks to be a trend that will continue.